Passing on a meaningful legacy involves much more than financial assets in today's ever-changing world. It encompasses values, family history, cherished traditions, and personal and emotional wealth preservation.

Through this blog, we’ll shed light on the importance of financial legacy planning to ensure a lasting impact on future generations. Let’s uncover the transformative power of legacy planning and discover how it can shape the legacy you leave behind.

What is Legacy Planning?

Legacy planning is the process by which individuals specify how they want their assets to be utilized after their death. It involves creating a comprehensive plan that may include establishing charitable trusts aligned with personal causes, setting up educational funds for future generations, and expressing moral sensibilities.

While estate plans focus on asset distribution, legacy plans go a step further by dictating how the distributed assets should be used.

How Does Legacy Planning Work?

Legacy planning utilizes financial tools like trusts to achieve long-term financial goals after the individual's passing. One advantage of legacy planning is that it helps bypass the potentially time-consuming probate process, which could delay asset distribution for months or even years.

In addition to financial considerations, legacy planning involves designating plans for sentimental items, family heirlooms, and valuable artworks. It may also involve preserving family history through video recordings, audio archives, or other easily accessible media.

A crucial element of a successful legacy plan is creating and regularly updating a will. This ensures that assets are distributed according to the benefactor's preferences and accounts for any changes in circumstances over their lifetime.

Why is Legacy Planning Important?

Neglecting financial legacy planning puts families at financial risk. Shockingly, statistics show that only 40% of Americans have taken the necessary steps to create a will or living trust, leaving the remaining 60% of the population vulnerable to the laws of the states where they reside.

By explicitly stating their wishes through legacy planning, individuals can prevent potential conflicts within the family and preserve its integrity. Additionally, legacy planning is crucial in minimizing the tax burden on the estate, potentially protecting more of the assets for future generations.

Benefits of Using My Wealth Locker for Family Legacy Planning

Centralized Digital Repository

My Wealth Locker provides a secure and centralized digital repository to store all your important documents, records, and digital assets related to your family legacy planning. This eliminates the hassle of managing physical documents and ensures easy access to crucial information whenever needed.

Preservation of Family History

With My Wealth Locker's digital tools, you can preserve and document your family's history, traditions, and stories. By securely storing and organizing digital media such as photos, videos, and audio recordings, you can pass down your family's unique legacy to future generations, fostering a sense of heritage and connection.

Secure Digital Asset Management

My Wealth Locker enables you to manage your digital assets, such as online accounts, social media profiles, and intellectual property. By securely storing login credentials and instructions, you can ensure that your digital presence is properly managed and transferred to your chosen beneficiaries, allowing them to inherit and continue your digital legacy.

Seamless Collaboration and Communication

My Wealth Locker facilitates collaboration and communication among family members involved in the legacy planning process. Through shared access, you can engage in discussions, share ideas, and collectively contribute to creating and preserving your family's legacy, promoting unity and harmony.

Privacy and Security

My Wealth Locker prioritizes the privacy and security of your digital assets and sensitive information. Utilizing encryption and robust security measures, it safeguards your data from unauthorized access, ensuring that your family's legacy remains protected and confidential.

Accessibility and Mobility

With My Wealth Locker's digital tools, you can access your family legacy plans and documents from anywhere, at any time, using various devices. This flexibility allows you to manage and update your legacy plans conveniently, ensuring they reflect your evolving wishes and circumstances.

Efficient Estate Planning Integration

My Wealth Locker seamlessly integrates with estate planning processes, allowing you to align your family legacy plans with your overall estate planning goals. By integrating digital tools with legal and financial considerations, you can create a comprehensive and cohesive legacy plan covering all wealth transfer and preservation aspects.

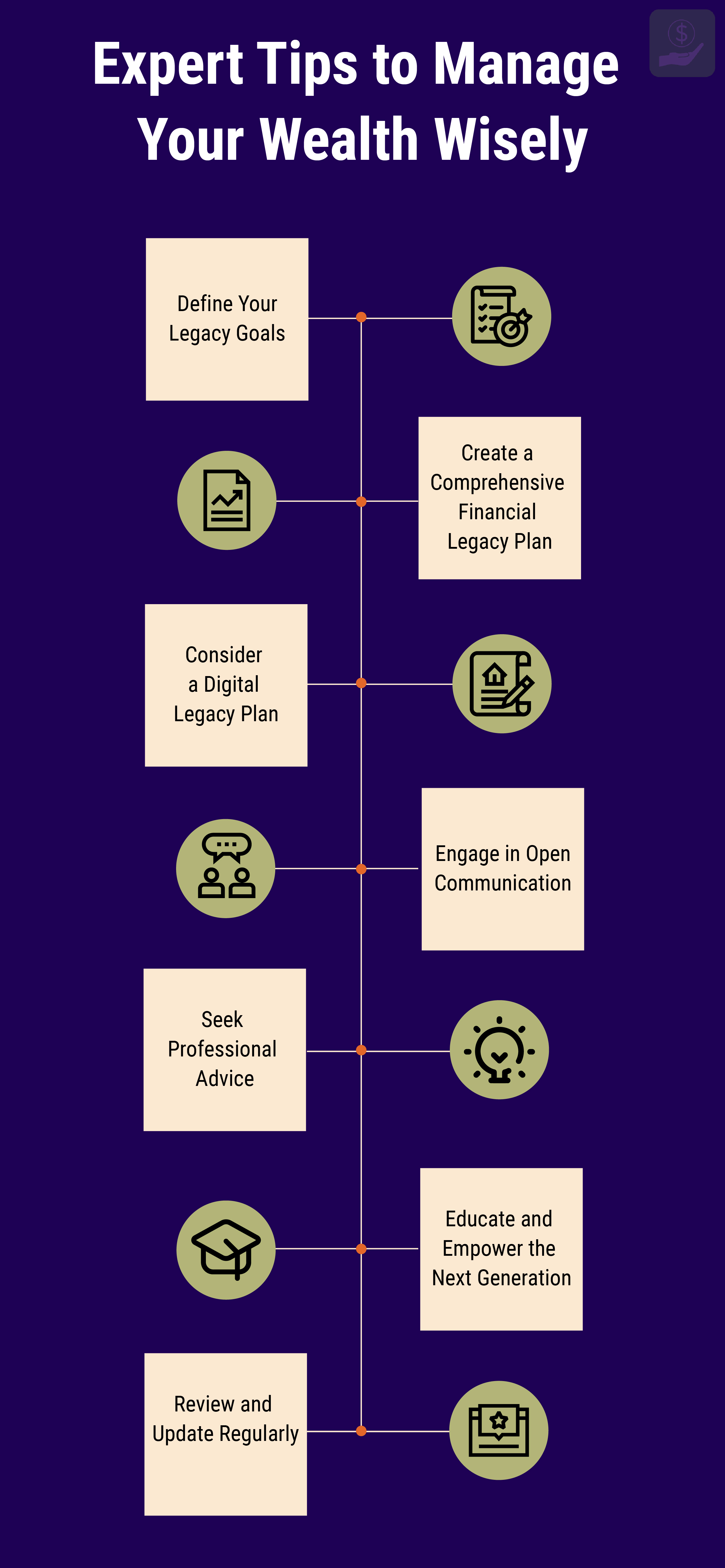

Tips to Manage Your Legacy Planning Smartly

Define Your Legacy Goals

Begin by clarifying your vision for the legacy you want to leave behind. Consider the financial aspect and the values, traditions, and principles you want to pass on. Think about the impact you wish to make on future generations.

Create a Comprehensive Financial Legacy Plan

Incorporate Financial Legacy Planning into your overall legacy strategy. This includes evaluating your current financial situation, setting financial goals for the future, and creating a plan to pass on your wealth to the next generation. Utilize tools like a Family Legacy Wealth Plan to outline specific steps and provisions for transferring financial assets.

Consider a Digital Legacy Plan

It's essential to account for your digital assets and online presence in the digital age. Develop a Digital Legacy Plan that outlines how you want your digital assets managed, including online accounts, social media profiles, and intellectual property. Specify who will have access and how you want your digital legacy to be preserved.

Engage in Open Communication

Share your intentions and plans with your family to foster understanding and unity. By involving your loved ones in discussions about your legacy, you can ensure that they understand your wishes and can actively participate in preserving and continuing your family's wealth and values.

Seek Professional Advice

Consult with estate planners, financial advisors, and legal professionals specializing in legacy planning. They can provide guidance and expertise, helping you navigate complex financial and legal matters and ensure your legacy plan aligns with your overall goals.

Educate and Empower the Next Generation

Prepare your heirs for the responsibilities of inheriting wealth. Educate them about financial literacy, wealth management, and the values that have shaped your family's success. Encourage their active involvement in the financial planning process and equip them with the knowledge and skills to carry on your legacy.

Review and Update Regularly

Life circumstances change, and so should your legacy plan. Regularly review and update your plan to reflect any significant life events, changes in financial circumstances, or shifts in your priorities. Keeping your legacy plan current ensures it remains relevant and effective in achieving your long-term goals.